J-Credit Scheme Explained: How Does it Work and What Are the Benefits?

- CO2-reduction

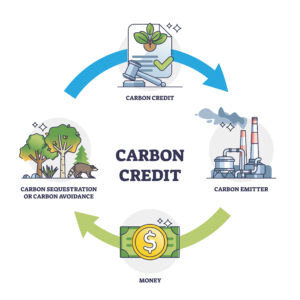

As the world actively seeks solutions to stop global warming, “carbon pricing” has emerged as a noteworthy approach.

One such method within carbon pricing is the J-Credit Scheme, which the Japanese government certifies greenhouse gases that have been reduced or absorbed as “credits.”

◎Key Takeaways

- Market-Based Approach: Allows companies and individuals to buy and sell carbon credits.

- Support for Diverse Activities: Includes renewable energy, energy saving, and forest conservation.

- Verification and Certification Process: Credits are only awarded for actual reductions or removals.

Table of Contents

What is the J-Credit Scheme?

J-Credits are certificates purchasable in Japan for carbon offsetting. These credits enable companies that cannot reduce their carbon emissions to offset these emissions and strive towards carbon neutrality.

J-Credits are operated collaboratively by the Ministry of the Environment, the Ministry of Economy, Trade and Industry, and the Ministry of Agriculture, Forestry, and Fisheries.

- Introduction of energy-saving equipment

- Reduction of greenhouse gas emissions through the use of renewable energy

- Absorption of greenhouse gases through proper forest management

The scheme converts these into credits, sell them, and use the funds for various purposes such as business expansion and recovery of investment costs.

Purchasing J-Credits has the benefit of not only contributing to the reduction and absorption of greenhouse gas emissions, but also expecting PR effects as an “environment-contributing company” and increased corporate reputation.

t-CO2 as the trading unit

J-Credits are measured in “t-CO2” (metric tons of carbon dioxide). This unit, widely used in greenhouse gas quantification, provides a standardized measure for emissions, absorption, recovery, and storage.

In the realm of J-Credit, the absorption capacity from forests and similar sources undergoes creditization. As illustrated below:

- Baseline: Predicted CO2 emissions in the absence of efforts toward emission reduction.

- Actual Emissions: The quantity of CO2 emitted as a result of engagement in emission reduction initiatives.

The difference between these values is officially recognized as a “credit.”

J-Credits demand rises in 2024

According to the J-Credit System data for 2024, the number of registered J-Credit projects reached a record high of 1,081. Additionally, the certified amount of carbon dioxide emission reductions was 9.36 million t-CO2.

In May 2023, the average successful bid price was 1.401 yen per kWh, indicating an increase in prices due to rising demand. These figures reflect Japan’s efforts in carbon emission reduction and the growing interest in environmental policies and climate change measures.

Consult with OFFSEL Now (free)▶︎▶︎▶︎

Consult with OFFSEL Now (free)▶︎▶︎▶︎

Benefits to purchase J-Credits

Appealing corporate environmental contributions

J-Credit buyers can actively showcase their commitment to environmental issues. By supporting activities such as carbon negative through J-Credit purchases, companies enhance their contributions to Environmental, Social, and Governance (ESG) and Sustainable Development Goals (SDGs) and enhance recognition from investors, financial institutions, consumers, and local communities.

Adding value to products and services

With the growing awareness of ethical consumption in Japan, offsetting greenhouse gas emissions associated with products or services through carbon offsetting adds value. This positioning as “environmentally conscious products or services” allows differentiation from competitors and aims for branding through added value.

※Ethical Consumption: Heightened awareness of consumers who consider environmental and ethical factors when making purchasing decisions.

Building connections with environmentally proactive entities

J-Credit purchases create connections with companies and local public entities actively engaged in reducing greenhouse gas emissions and sustainable forest management. This networking opens doors to new business opportunities and contributes to the creation of business models addressing environmental issues.

Benefits to create J-Credits

Profit from credit sales

Once J-credit has generated, it can be sold for a profit. The proceeds can be reinvested in activities such as facility improvements or further initiatives for reducing greenhouse gas emissions or increasing absorption.

Show commitments to climate action

The creation of J-Credit allows for a proactive demonstration of commitment to climate change mitigation. In recent years, funding for greenhouse gas reduction projects, including those generating J-Credit, has become accessible through sustainable finance and green finance.

※Sustainable Finance: Financial systems contributing to building a sustainable society.

※Green Finance: Funding system specialized in projects addressing environmental issues.

Conscious shift in Greenhouse Gas reduction within companies

Participation in the J-Credit scheme visualizes a company’s commitment to reducing greenhouse gas emissions numerically. Sharing information about in-house greenhouse gas reduction efforts fosters awareness and brings about a shift in consciousness towards environmental issues and management reform.

Consult with OFFSEL Now (free)▶︎▶︎▶︎

Consult with OFFSEL Now (free)▶︎▶︎▶︎

Disadvantages of J-Credit Scheme

Time and cost intensive credit creation

Creating J-Credit involves a meticulous process:

- Formulating a CO2 emission reduction plan

- Documenting the plan in a report

- Applying for project registration upon approval of the plan’s validity

- Analyzing and collecting data post-initiation

- Creating a verification report

- Applying for credit certification

- Committee review

- Credit approval, marking the completion of J-Credit creation

The process incurs substantial time, cost, and effort, with even government support leaving small to medium enterprises with a self-payment burden of around ¥100,000-¥200,000.

Low recognition

While the registration and certification of J-Credit are steadily increasing, the overall societal recognition is still low. Understanding the “value” of greenhouse gas reduction and CO2 absorption by forests is directly tied to recognizing the societal cost of addressing emissions.

With increasing demand for J-Credit, the market average bidding price is rising. As awareness grows, both recognition and market size are expected to increase.

Small market size

Attributed to factors like being a nascent trading market, time-consuming creation and certification, and low credit production, the J-Credit market size is relatively small. Addressing this requires strategies such as expanding incentives for system users, improving credit transaction environments, and easing the burden on credit creators.

Prospects for J-Credit growth

J-Credit is still in its early stages. Active efforts by relevant authorities to facilitate early expansion reflect the potential impact J-Credit could have in contributing to a carbon-neutral future. Now that we’ve explored the merits, drawbacks, and challenges of J-Credit, the next section will provide a detailed overview of the creation and purchasing processes.

In measuring the invisible reductions and absorptions of greenhouse gases, it is crucial to employ fair and accurate methods and technologies. This necessity results in the current lengthy process of approximately four years from the creation to the sale of J-Credit.

How to create J-Credits

J-Credit allows participation from a wide range of entities, from industrial corporations to individuals. In this section, let’s briefly outline the steps for both creating and purchasing J-Credit.

There are two ways to create J-Credit;

- NORMAL case: the basic method for generating J-Credit involves registering reduction activities within a single facility or business location as a singular project.

- PROGRAM case: consolidating multiple reduction or absorption activities, such as installing solar power generation facilities on residential rooftops, and registering them as a single project.

Each purchasing method is detailed on the J-Credit scheme website, including a matchmaking section to facilitate connections between creators and buyers.

How to get certified from J-Credit

- Implement or plan projects for reducing greenhouse gas emissions or managing forests.

- Consult with the J-Credit Scheme Secretariat.

- Confirm the details and scope of financial support needed during the examination and verification process.

- Create a “Project Plan” outlining how J-Credit will be generated through the project.

- Submit the “Project Plan” and undergo the review process.

- After deliberation by the J-Credit Scheme Certification Committee, if approved, the program is registered as a J-Credit generation program.

- Based on the project plan, conduct monitoring (measurement) for calculating greenhouse gas emission reduction or absorption.

- Create a monitoring report and undergo credit authentication.

- Utilize the authenticated credits.

Examining these steps reveals the intricacies involved in the process. However, the creation of a “value recognized by the country” necessitates reliability.

Additionally, measuring the unseen reductions in greenhouse gas emissions or absorptions requires methods and technologies ensuring fair and accurate measurements. Due to these factors, the entire process from J-Credit generation to sale currently takes approximately four years.

Three ways to buy J-Credit

- J-Credit Intermediary Providers

- Purchase J-Credit listed in the “Credit Listing” section.

- Purchase through bidding sales conducted by the J-Credit Scheme Secretariat.

Information for each purchasing method is available on the J-Credit Scheme website. Additionally, there’s a matching corner for creators and buyers to enhance J-Credit activation.

| ※ Bidding Sales: a system where prospective buyers or companies seeking project contracts submit documents (bids) detailing amounts, and the best conditions proposed by bidders are chosen as the successful bidder by sellers or ordering agencies. |

The time-consuming aspect of J-Credit generation is due to the fact that initiatives allowing for immediate cost recovery are not eligible. J-Credit is aimed at projects where cost recovery takes three years or more.

However, considering the economy’s past focus on mass production, consumption, and disposal for short-term gains, there is a need for a prompt reevaluation. Although the J-Credit transactions aim for rapid expansion to achieve carbon neutrality by 2050, it emphasizes the fundamental importance of consistently adopting a long-term perspective for the transformation into a sustainable society.

Purchasing J-Credits through OFFSEL

The reselling service ‘OFFSEL‘ operated by Erevista Co., Ltd., offers a comprehensive service for purchasing non-fossil certificates and J-credits, including creating estimates, purchasing, and transferring rights.

OFFSEL also features competitive pricing and offering certificates for as low as 0.32 yen per kWh while the average costs are from 0.4 to 1.0 yen per kWh. It is beneficial if businesses prefer to purchase small amounts with low prices and costs down.

As the renewable energy system requires more costs for development and implementation than fossil fuels, businesses need to invest more money.

Frequently Asked Questions about J-Credit

Why hasn’t J-Credit gained widespread adoption?

Factors such as the recent initiation of the trading market, the time-consuming creation and certification process, and low credit production contribute to J-Credit’s limited societal recognition.

Can Individuals engage in buying and selling?

J-Credit can be bought or sold by individuals. The average trading price in April 2022 was ¥1,607/t-CO2. With a minimum purchase requirement of 1,000t-CO2, individuals can engage in transactions, starting from approximately ¥1,607,000.

While J-Credit faces challenges, their potential for contributing to a carbon-neutral future is significant. Understanding the intricacies of creation, purchase, and addressing common queries is crucial for both experts and those new to the field.

You May Also Interested in:

What is the Blue Carbon? The importance of its system, and pros and cons

What Are I-RECs (International Renewable Certificates) And How They Work?

A Guide Of Green Power Certificates: Explaining Merits And Challenges

CONTACT US

Please feel free to contact us at anytime.

We will get back to you as soon as we

can!

Editor

OFFSEL Owned by Erevista Inc, OFFSEL is specializes in Environmental issues, especially in carbon neutrality. We primarily provide the latest information on environmental energy.