Advantages and Disadvantages of Carbon Credits

- CO2-reduction

Table of Contents

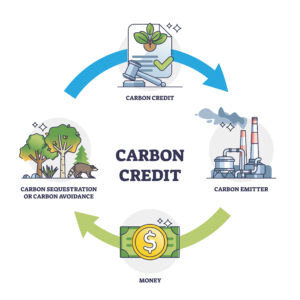

What are carbon credits?

Carbon credits are a tradable certificate that allows companies to buy and sell the amount of greenhouse gas emissions.

In recent years, every company has been required to reduce greenhouse gas emissions in order to achieve carbon neutrality in 2050. Particularly for large companies, efforts to reduce emissions are becoming social responsibility.

On the other hand, there are some industries where it is difficult to reduce greenhouse gas emissions, such as the aviation and energy industries. Companies in these industries can contribute to reduce emissions by purchasing carbon credits.

Two different carbon credit trading systems

Carbon credits have been divided into two trading systems: the Baseline & Credit System (Reduction Trading) and the Cap & Trade System (Allowance Trading).

Baseline & Credit System (Reduction Trading)

The Baseline & Credit System allows trading based on the amount of greenhouse gas reduction. The amount is the difference from the original emissions (baseline) of the business.

- Emissions if no reduction project is implemented: 10,000 tons

- Emissions achieved by implementing reduction projects: 7,000 tons

- Surplus quota that can be sold: 3,000 tons

In this case, there is a difference of 3,000 tons between the baseline and actual emissions, and that is the surplus that can be sold to other companies by generating credits.

The baseline and credit method trades “emissions” rather than emissions allowances, so there is the advantage of making it easy for any business to reduce the amount of emissions.

Cap-and-trade system (emissions trading)

The cap-and-trade system trades according to greenhouse gas emissions allowances. In this method, each business has an upper limit (cap) on how much they can emit, and when they have excess emission allowances, they sell the surplus to other companies, and they purchase allowances from other companies when they do not have enough.

- Company A sells the surplus 2,000 tons of the 10,000 tons of emission allowances: Gains from the sale

- Company B buys 2,000 tons of surplus allowances from Company A to make up for the shortage of emission allowances: allowances increase.

The advantage of the cap-and-trade system is that it greatly benefits businesses that make large reductions, or those who sell emissions allowances. On the other hand, businesses that have not reached their reduction targets will have to make their own money to secure emissions allowances.

Advantages of carbon credits

Offsetting greenhouse gas emissions

By purchasing carbon credits, businesses can offset greenhouse gas (GHG) emissions that they are unable to completely reduce.

While it would be ideal for all businesses to uniformly “significantly reduce greenhouse gas emissions,” this is not always realistic. Therefore, businesses can address the portions of emissions they cannot reduce by investing in carbon credits, incurring a financial cost.

Appealing commitment to decarbonization

Purchasing carbon credits allows companies to declare their commitment to decarbonization with clear guidelines and tangible activities. This declaration can be a social acknowledgment of a company’s efforts toward decarbonization. By making such declarations, companies may also encourage others in their industry to follow suit, creating a positive cycle.

It is crucial to publicly announce participation in carbon credit initiatives on websites and social media. Broadcasting this commitment through widely accessible channels can increase public awareness and interest in environmental initiatives.

Economic incentives for reducing emissions

Carbon credits create a market-based system where companies are financially motivated to lower their carbon emissions. By putting a price on carbon, it encourages investment in cleaner, more efficient technologies. This market-driven approach provides a flexible and cost-effective means for businesses to meet environmental targets.

Global reach and scalability

The carbon credit mechanism has a widespread impact due to its global applicability and scalability.

Carbon credits operate on an international scale, enabling countries and companies around the world to collaborate in reducing emissions. This global framework facilitates the transfer of green technologies and sustainable practices across national boundaries, enhancing the collective effort against climate change.

Disadvantages of carbon credits

Potential for market fluctuations and instability

The carbon credit market, while innovative in its approach to reducing emissions, is not immune to economic and policy-related fluctuations. These changes can significantly impact the value and stability of carbon credits, thereby affecting the overall effectiveness of the carbon trading system.

Economic influences on the carbon market

The carbon credit market is intricately linked to broader economic conditions. During periods of economic growth, there is often an increased demand for carbon credits, which can drive up prices. Conversely, in times of economic downturn, the demand for carbon credits tends to decrease, leading to lower prices. This volatility can affect the financial viability of carbon reduction projects and may deter future investment in carbon credit initiatives.

Major carbon credit markets in the world

1. European Union Emissions Trading System (EU-ETS)

Established in 2005, EU-ETS is the world’s largest emissions trading market. Companies across Europe participate, and those exceeding their allocated emission allowances face fines.

Additionally, surplus allowances can be sold to other companies. EU-ETS plays a central role in Europe’s climate change efforts, and now also includes the aviation and maritime industries.

2. United Kingdom Emissions Trading System (UK-ETS)

Established in 2021, UK-ETS is a new system operating independently from EU-ETS. It covers industries and energy sectors within the UK, providing a market mechanism to achieve emission reduction targets.

UK-ETS is a crucial tool for the UK to actively engage in international climate change efforts post-Brexit, promoting sustainable business practices with strict emission standards.

3. Australia’s Emissions Reduction Fund (ERF)

Australia’s ERF is a system where the government funds projects conducted by companies, agriculture, and forest managers to reduce emissions. ERF issues credits for these reduction projects, which can be traded in the market.

Projects include renewable energy introduction, energy efficiency improvements, and forest protection. ERF is a key tool in Australia’s climate change strategy and supports sustainable regional development.

4. China Emissions Trading System (CN-ETS)

China officially launched its national emissions trading system in 2021, a significant initiative in the world’s most populous and energy-consuming country. Initially focusing on the power sector, CN-ETS plans to expand to other industrial sectors.

Operated through cooperation between local governments and companies, CN-ETS provides incentives for technological innovation and energy efficiency improvements.

5. California Cap-and-Trade Program (USA)

The state of California in the United States launched its own emissions trading system in 2012. Covering a wide range of sectors including energy, industry, and transportation, California’s program is a key tool to achieve state greenhouse gas emission reduction targets.

The state aims to balance emission reductions with economic growth, promoting clean energy adoption and zero-emission vehicle implementation.

Official website of California Cap-and Trade Program

6. Singapore’s AirCarbon Exchange (ACX)

Singapore’s ACX (AirCarbon Exchange) aims to be a hub for the carbon credit market in Asia. ACX supports companies in achieving their emission reduction goals through credit trading, with participants expected from across Asia.

Leveraging Singapore’s strategic position and economic influence, ACX contributes to emission reductions throughout Asia. ACX utilizes blockchain technology to enhance transparency and efficiency in trading.

Current situation of carbon credits in Japan

In Japan, the government has introduced the Joint Crediting Mechanism (JCM) and J-Credit as credit mechanisms. J-Credit involves the certification of efforts contributing to greenhouse gas reduction or absorption by the government. Verified credits can be purchased and publicly disclosed by buyers, including businesses, local governments, farmers, and forest owners.

Local Government Initiatives

Apart from national mechanisms, Tokyo and Saitama have adopted their own Cap & Trade systems, allowing trading of emission allowances beyond mandated reduction levels. Interprefectural cooperation is observed between Tokyo and Saitama. Other regions like Kyoto and Shiga also implement their unique credit systems.

Private Initiatives

In addition to initiatives led by international and government bodies, private organizations also engage in voluntary credit mechanisms.

While carbon credits focus on trading reduced emissions, non-fossil certificates verify the environmental value of “non-fossil electricity.” These certificates demonstrate the use of clean electricity, supporting companies in incorporating environmentally conscious energy plans.

Carbon Credits in Japan

J-Credit

Cited from: J-Credit Scheme

Cited from: J-Credit Scheme

Apart from the Joint Crediting Mechanism (JCM), the Japanese government has introduced another mechanism known as J-Credit.

In the J-Credit scheme, the government (including the Ministry of Economy, Trade and Industry, Ministry of Agriculture, Forestry and Fisheries, and Ministry of the Environment) certifies efforts by credit creators that contribute to reducing greenhouse gas emissions or increasing absorption.

The certified credits can be purchased by buyers, typically corporations or local governments, and then publicly disclosed as part of their own reduction achievements.

Credit creators encompass entities like companies, local governments, farmers, and forest owners, while buyers are generally assumed to be corporations or local governments.

Local Government Systems

In addition to the national approach, Tokyo and Saitama prefectures have independently implemented their own carbon credit systems. Both prefectures use a cap-and-trade system where emission allowances can be traded. This means that businesses can trade credits for emissions reductions beyond their specified “reduction obligation.” Collaboration between Tokyo and Saitama is actively taking place.

Additionally, Kyoto Prefecture (Kyoto-VER) and Shiga Prefecture (Biwako Credit) have their own unique systems. Apart from mechanisms led by international and government bodies, there are also voluntary initiatives by private organizations.

J-Blue Credits

“J-Blue Credits” is a certification system established by the Japan Blue Economy Technology Research Association, specifically focusing on blue carbon.

Blue carbon refers to the carbon absorbed by marine ecosystems such as algae, seagrasses, and mangroves. The system was initiated in 2020, and in its inaugural year, four credits were issued.

Contact with OFFSEL about Carbon Credis

If you are interested in purchasing or creating carbon credits, OFFSEL is there for you.

OFFSEL is a service that procures carbon credits, such as “non-fossil certificates,” on behalf of clients.

With OFFSEL, you can not only achieve carbon offsetting easily and at low cost, but also showcase your carbon offset efforts externally.

If you would like to consult about carbon credits, please contact OFFSEL.

Related Article:

What is the Blue Carbon? The importance of its system, and pros and cons

You Also Interested In:

A guide of Carbon Neutrality – What is the Difference between Net Zero and Decarbonization?

What Are I-RECs (International Renewable Certificates) And How They Work?

CONTACT US

Please feel free to contact us at anytime.

We will get back to you as soon as we

can!

Editor

OFFSEL Owned by Erevista Inc, OFFSEL is specializes in Environmental issues, especially in carbon neutrality. We primarily provide the latest information on environmental energy.